- BEST WAY TO TRACK PERSONAL FINANCES PROFESSIONAL

- BEST WAY TO TRACK PERSONAL FINANCES DOWNLOAD

- BEST WAY TO TRACK PERSONAL FINANCES FREE

Separate Business Expenses and Personal Expenses.

BEST WAY TO TRACK PERSONAL FINANCES DOWNLOAD

Download an Expense Tracker App – such as Mint in the US or Lumio in the UK.

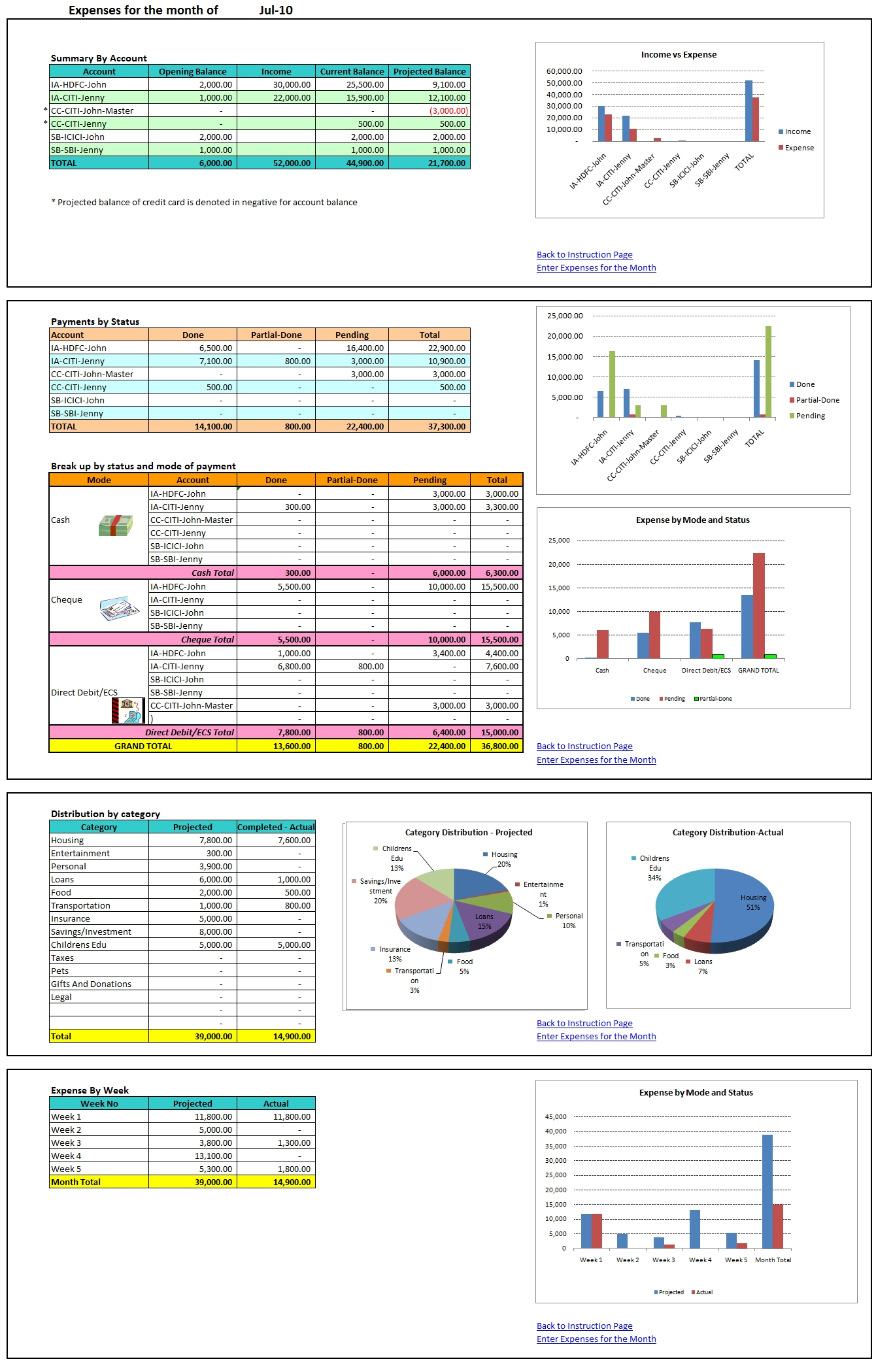

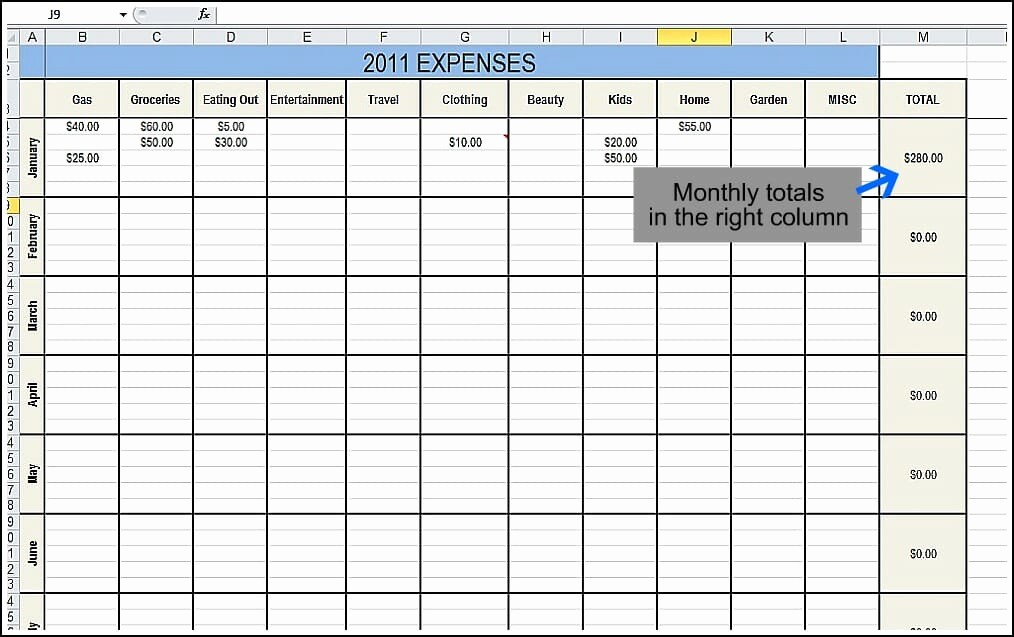

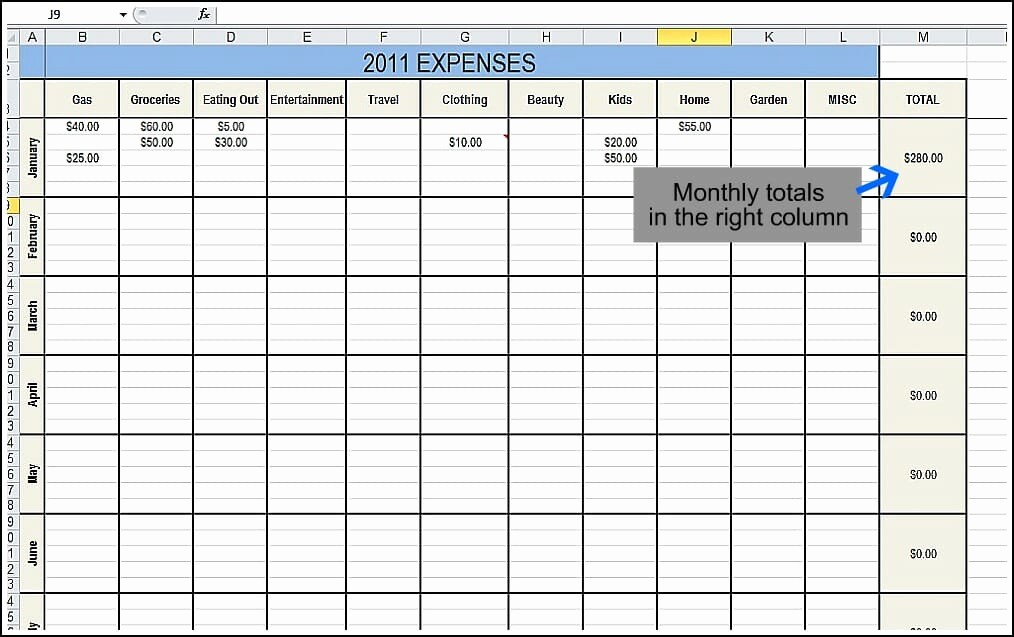

Segment Your Spending Methods Into Categories. Before we dive into the detail here are the key takeaways: TL DR We’ve gathered the best practices and methods to help ease you into expense tracking. If you’re looking to start tracking your spending and expenses, keep reading! The key is to getting a handle on it before it gets out of control. Well, it’s most likely because you weren’t paying attention to what you were spending! We all do it from time to time. You’ll find yourself wondering, “How did I spend that much?” Often, we don’t review our budgets until our spending gets out of hand. You’ll find that exercising more control over your personal expenses today can pay huge dividends in your quality of life tomorrow.A big part of sticking to a budget is knowing how much you spend. Take the opportunity to continue tracking, evaluating, and revising your financial plan. A big promotion-or an unexpected layoff-can create major changes in your financial picture. Some life events may cause you to shift your focus. As you move forward, some of your goals may change.

Segment Your Spending Methods Into Categories. Before we dive into the detail here are the key takeaways: TL DR We’ve gathered the best practices and methods to help ease you into expense tracking. If you’re looking to start tracking your spending and expenses, keep reading! The key is to getting a handle on it before it gets out of control. Well, it’s most likely because you weren’t paying attention to what you were spending! We all do it from time to time. You’ll find yourself wondering, “How did I spend that much?” Often, we don’t review our budgets until our spending gets out of hand. You’ll find that exercising more control over your personal expenses today can pay huge dividends in your quality of life tomorrow.A big part of sticking to a budget is knowing how much you spend. Take the opportunity to continue tracking, evaluating, and revising your financial plan. A big promotion-or an unexpected layoff-can create major changes in your financial picture. Some life events may cause you to shift your focus. As you move forward, some of your goals may change.

It is an ongoing commitment to tracking, planning, and prioritizing the various facets of your financial life. Managing your personal expenses is not something that you do once. It’s also the time for you to revisit your spending habits and evaluate how cutting out mindless shopping, selling some assets, or even generating extra income can create more cash flow and get you to your goals faster.

BEST WAY TO TRACK PERSONAL FINANCES FREE

Again, you’ll want to formulate both short-term and long-term goals and understand how each one impacts the next.įor example, if one of your goals is to pay off debt, you’ll find that prioritizing that goal will free up money to make many of your other goals a reality.

BEST WAY TO TRACK PERSONAL FINANCES PROFESSIONAL

Once you have gathered your information, set goals, and consulted a professional about economic strategies, it’s time to make a financial plan. In addition, your planner can help you create a realistic timeline so that you have a better sense of what to prioritize. Now is also a good time for you to consider working with a financial planner who can help you better understand your investment options and share strategies to help you accomplish your goals. How much of your spending is getting you closer to the goals that you have in mind? This type of planning also helps motivate you as you develop new money habits.

Help your parents or other family membersĬreating a list of short-term and long-term goals, then prioritizing those goals, can help you look back at your spending with fresh eyes. Set your goalsĪt this stage, put aside your budget and spend some time thinking about what you would like to accomplish over the next year. Even if you have the money to support your current spending habits, you may find that you’d like to make changes for other reasons, including simplifying your routine or minimizing your acquisition of random “stuff.” 3. While you don’t need to make changes at this point, taking note of your habits and of how they affect your financial bottom line will become crucial as you start to set financial goals. Are you an emotional shopper or one who buys things out of boredom rather than necessity?. Do you frequently pick up the check for others, at the expense of your bank account?.  Do you tend to join subscription services that you’re not using?. Are you too reliant on credit, resulting in a hefty credit card balance and inflated interest charges?.

Do you tend to join subscription services that you’re not using?. Are you too reliant on credit, resulting in a hefty credit card balance and inflated interest charges?.

Analyze your habitsĪfter you’ve accounted for all of your spendings, it’s time to think about the habits you developed. Make better decisions backed by data and insights Learn More 2.

0 kommentar(er)

0 kommentar(er)